If you’re excited about why it’s best to proceed assembly together with your monetary advisor, you have got already taken a giant step towards securing your monetary future – you have got engaged the providers of knowledgeable. Now, how typically it’s essential to meet together with your advisor relies on the diploma of assist wanted by you. In case your monetary affairs are advanced in nature that require the next frequency of supervision reminiscent of overseeing an property, sale of an actual property property, having a number of investments throughout completely different asset courses and sectors, and so forth., you could want to fulfill together with your advisor each month or so. Nevertheless, in case your monetary issues are fairly simple as a result of having fewer investments otherwise you being a brand new investor, you could get by assembly each six months or yearly to evaluate and replace your monetary plan.

That stated, it’s fairly widespread for folks to surprise – How typically ought to I meet with my monetary advisor? What to anticipate when assembly with a monetary advisor? And so forth. If you want a agency grip in your funds and wish to find out about completely different methods associated to investing, tax-saving, or retirement planning, seek the advice of with knowledgeable monetary advisor who can advise you on the identical.

Why must you proceed assembly your monetary advisor?

There are a number of the reason why it’s best to proceed seeing your monetary advisor. There is no such thing as a proper reply on how typically it’s best to meet together with your monetary advisor. If you’re about to make a significant funding or must sort out a severe monetary concern, it’s best to e-book a gathering instantly. Allow us to focus on just a few the reason why it’s best to search a monetary advisor’s counsel and proceed seeing them.

1. You want an professional’s steering relating to monetary planning

Arguably crucial purpose why it’s best to meet with a monetary advisor is to hunt steering on tips on how to successfully plan your monetary journey so you’ll be able to attain your monetary objectives and targets.

Whether or not you’re a younger particular person or any individual heading into retirement, monetary planning and its significance ought to by no means be uncared for. Each side of your monetary life calls for planning, proper from insurance coverage and well being care to taxes and investments. A monetary advisor right here may be the perfect supply of steering. So, if you would like a hassle-free monetary journey, you’ll be able to search your advisor’s counsel and meet them frequently.

2. You need assistance making a funds

Budgeting is among the most essential facets of economic planning. When your earnings is nominal, you could possibly handle your entire budgeting course of independently. However, as soon as it will increase past a sure stage, you could must get in contact with an professional to raised handle your bills and earnings.

Additionally, you can not enter the retirement part with no well-planned funds. It’s essential to have a good concept of your funds and the way a lot you’ll be able to afford to spend to dwell comfortably in retirement. A well-planned funds will spotlight your mounted bills and also will think about essential bills like medical payments, lease, and so forth.

You must frequently meet together with your monetary planner to funds and handle your funds as per your current and future wants.

3. It’s essential to evaluate your monetary plan at common intervals

Whereas planning is essential, reviewing its implementation is equally essential too. It’s essential to monitor your taxes, insurance coverage, investments, and extra to make sure that you’re heading in the right direction.

Conducting an intensive evaluate can provide you a good concept of how your plan is working and if there’s a want for change in technique. It additionally helps to be totally conscious of the place and the way your cash is employed. That is greatest performed via a private assembly together with your monetary advisor. Your advisor can navigate you thru all of your brief and long-term plans and objectives and enable you to give attention to attaining them.

How typically must you communicate to your monetary advisor?

You may surprise how typically do monetary advisors meet with purchasers. The variety of conferences relies on your monetary wants and the diploma of enable you to want.

If there are any problems together with your funds or investments, you may even must seek the advice of an advisor both weekly or month-to-month. Nevertheless, when you’ve got a daily supply of earnings and some easy investments, you’ll be able to attain out to your advisor often.

All stated, it’s best to attempt to attain out to your monetary advisor no less than yearly. The yearly assembly will enable you to perceive whether or not you’re on observe to fulfill your monetary objectives or not in addition to if it’s essential to make any adjustments to your plan. The advisor will evaluate all of your methods and advocate adjustments you’ll be able to incorporate.

When must you attain out to your monetary advisor?

Whereas assembly together with your advisor no less than yearly is suggested, there could also be occasions when you could want to instantly discuss to your advisor. You must attempt to meet your advisor within the following conditions:

1. At completely different life levels

Individuals undergo completely different phases of their life reminiscent of marriage, beginning, persistent illness, or divorce. These adjustments can considerably impression your funds. Therefore, if you happen to foresee your self coming into any of those phases, or if these phases come into your life unannounced, it might be time to fulfill your monetary advisor.

2. In the event you’re beginning your first or a brand new job

If you’re new to the world of finance and beginning with a brand new job, you could wish to attain out to your monetary advisor. The advisor might help you decide the best investments as per your threat urge for food and earnings stage, advise you on which retirement account to open, which insurance coverage coverage to purchase, and extra. They will additionally information you on tackling completely different monetary conditions reminiscent of making well timed retirement account contributions, promotions at work, altering wage packages, receiving sudden inheritances, and extra.

3. Whenever you’re planning for retirement

If you’re planning for retirement, it might be time to see your monetary advisor. Talk about your future objectives, the sort of life-style you could want to dwell in retirement, when to make withdrawals, tips on how to maximize your Social Safety advantages, tips on how to develop further streams of earnings, and extra together with your advisor.

4. Whenever you’re contemplating drawing a mortgage

Drawing a mortgage can considerably impression your monetary well being. It’s essential to attain out to your advisor if you happen to plan to purchase a brand new automotive on EMI, buy a home on mortgage, or must take out a mortgage for every other purpose. Whilst you may assume you’re able to tackle the debt, your monetary advisor can precisely decide the professionals and cons of your choice, retaining in thoughts your present wants and monetary state of affairs. The evaluation might help you arrive on the proper choice.

5. In the event you’re inheriting a big sum of cash or coming into sudden wealth

It could occur that you just inherit a big sum of cash or accumulate appreciable wealth by promoting an asset. A sudden inflow of an enormous amount of money is likely to be time to achieve out to your advisor. They might help you cope with the following repercussions associated to tax and different authorized formalities and advise you on the very best manner to make use of or make investments your cash.

6. Whenever you’re planning your legacy

You may search steering out of your monetary advisor in case you are excited about the sort of legacy you wish to go away for your loved ones and youngsters. Moreover, In case you have any philanthropic objectives post-retirement, you could wish to perceive how a lot you’ll be able to spend on charity and the next tax breaks that you’d be eligible to obtain. Do search their counsel in case you are contemplating which of your beneficiaries will inherit your online business. Enterprise succession planning is significant to make sure that your legacy lives on after your demise. Additionally, do guarantee that you’ve got reviewed and up to date your property plan as per your needs.

To conclude

The world is quick evolving and so are the funding choices at your disposal. You must attain out to your monetary advisor if you wish to maintain observe of the adjustments and take advantage of out of the fast-developing alternatives on the earth of investments. You must make it a behavior of assembly your advisor frequently to go over your monetary affairs and make adjustments as and when wanted. Protecting a detailed eye in your funds would serve you in good stead. If you wish to keep away from the effort or really feel your affairs don’t warrant shut monitoring, you’ll be able to arrange a gathering together with your monetary advisor yearly to go over how nicely they’re managing your funds.

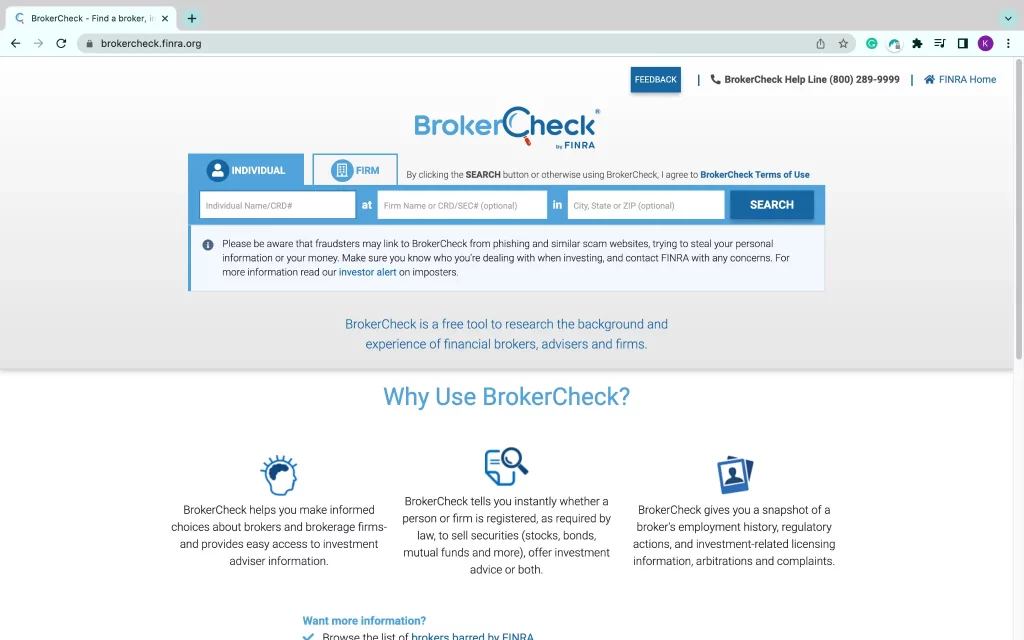

Use the free advisor match software to match with skilled and licensed monetary advisors who will be capable of information and advise you successfully on tips on how to greatest handle your funds and replace your monetary plan as per your altering wants and objectives. Give us primary particulars about your self, and the match service will join you with 1-3 skilled monetary fiduciaries that could be suited that can assist you.